How to Spend Money Wisely and Live a Meaningful Life

There are many tips on how to spend money wisely, but not all of them can lead to a meaningful life. Knowing how to properly distribute your finances is wise. However, you can make your life more meaningful if you are able to grow what you have. Discover the ways you can manage and increase your finances below!

How to Spend Money Wisely and Grow Your Finances

Tip #1: Create A Budget

Having a planned budget is one of the best steps towards understanding how to spend money wisely you can take. Each cent that we earn is important, so we should also know where they’re going. If you’re not used to living on a budget, you can start by laying out the following facts:

- Your income

- The regular bills you need to pay

- The essential purchases you regularly make

Once you have put these in perspective, start figuring out or estimating how much you spend on the last two items. You can also track your expenses by writing down each purchase you make. Are you living within your means, or are your expenses higher than the income you make?

If you spend more than you should, create action plans to cut down your expenses. One of the ways you can do this is by planning your purchases. This way, you can set aside money for them before you actually go to the store.

Controlling the money you spend might sound restrictive, but it actually gives you more financial freedom. Now, you won’t have to worry where your income goes. Knowing your fixed expenses will give you a clear grasp of your financial situation. Additionally, it makes it easier for you to plan out purchases not included in your fixed expenses.

Tip #2: Set Aside Savings

Just as you should understand how to spend money wisely, you need to know how to save wisely. After determining your expenses, don’t forget to include savings in your budget. This money comes from the money you have left over after your expenses.

A good saving habit to develop is to set aside funds for short-term and long-term savings, along with contingency money. Funds for things like vacations, quick fixes around the house, and appliance replacements can be the purpose of your short-term saving. Then those that require significant funding like a car or house renovation can come from your long-term savings.

Having a contingency fund is important. This will come in handy should you encounter situations that will require you to shell out money immediately. This fund is also helpful if you temporarily lose your source of income. The ideal contingency fund is the equivalent of three to six months of your income.

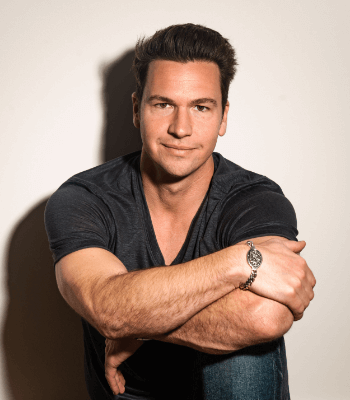

I saw the importance of setting aside savings after I lost my possessions as a result of my recklessness. This happened when I was starting out my entrepreneurial career. I neglected the fact that my business wasn’t completely off the ground yet, and I didn’t have many funds. Instead, I kept up with the luxurious lifestyle I’d developed back when I earned six figures in the insurance industry.

I had to learn the importance of saving and spending my money wisely the hard way. So take it from me — it’s better to be in control of your finances than to let them control you.

Read Also: How I Built My Multi-Million Dollar Company from Scratch

Tip #3: Resist Impulsive Purchases

You’ve heard of the term “impulsive buyer.” This is a phrase you do not want to be associated with. More often than not, impulsive buyers regret their decisions afterward.

Avoid being tempted to make purchases that are not aligned with your budget. Make sure you have a clear purpose whenever you visit the mall or stores. Further, if window shopping makes you think you have to buy something, then start avoiding it. Instead, think through your purchase decisions clearly and early, especially if a large amount of money is involved.

If you know people who are influential impulsive buyers, it might be best cut down on your time with them. After all, they will most likely influence or pressure you into buying something you hadn’t planned for. Consequently, this will have an unfavorable effect on your budget allocation.

Tip #4: Research Important Purchases

The internet makes information easily accessible with just the touch of a button. Use it to your advantage by conducting thorough research before you buy products and services. This is especially advisable when you plan to make an expensive purchase. Check which products will give you the best value for your money and what other customers say about it. These will help you make the right purchase decision and answer any questions of how to spend money wisely.

On the money-making side, if you are a life coach like myself, you should also take advantage of the internet. Introduce and build up the programs you offer through content marketing and other online presentations. That way, when a potential customer is on the lookout for services you can offer, you’ll be their top-of-mind-choice.

Read Also: Online Client Booking System: How to Create A Free Consulting Funnel

Tip #5: Go for Quality

Some people think that the best way to save is to always go for the cheapest option. However, that is not always true. As I mentioned earlier, you need to find the best value for your money. That means you have to be meticulous in judging the quality of the product or service you will purchase.

Think about it this way: it would be wiser to purchase a high-quality and sturdy pair of shoes, even though they’re pricey, as opposed to buying a cheap pair that will wear out in less than 6 months. Furthermore, if you keep on replacing your objects with things of the same quality, you’ll end up spending just as much or even more than the high-quality price.

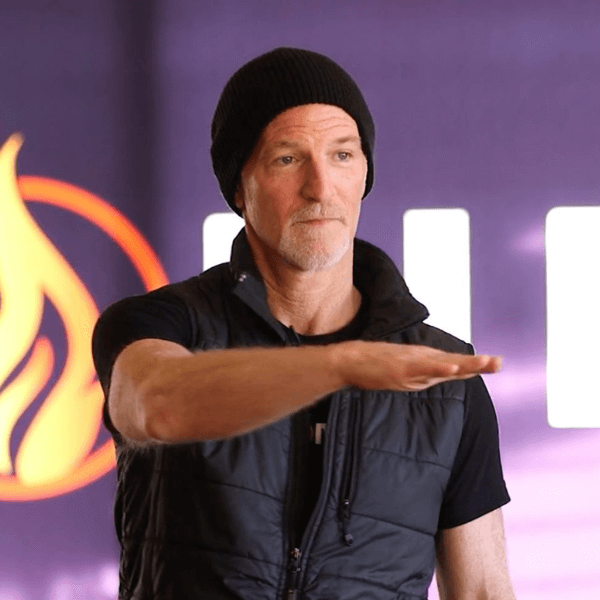

I honestly understand the instinct of some people to always go for the inexpensive option. This is actually why I created my low-tier marketing funnel and developed the staircase model. Some of my clients are not ready to purchase my high-end programs right away. With this in mind, I elevate them to make deeper purchase decisions gradually.

Personally, I don’t want my clients to just settle for the low- and mid-tier offers. Those products will only get them informed. My end goal is to have my clients engage with me on a bigger level. And that means elevating them to my high-end program offers, where they will encounter a deeper transformation.

Tip #6: Invest Your Money

We’ve talked about saving part of your income, which basically just stores away your money until you need it. However, you can make your life more meaningful if you can grow your finances. You can do this through investments. When you invest your money wisely, it will do the work for you and give you a good return.

It is highly advisable that you consult with a credible financial planner before making investment decisions. They will help you evaluate not only your financial goals, but also your risk tolerance for investments.

Another form of investment you can make is to purchase high-quality products and services. A good investment will give you at least the value of your money, if not more. Additionally, it will be beneficial in the long run.

For instance, a high-end coaching program is a form of investment. It may be pricey, but you’ll also get more out of it. This is what I tell my clients, because it’s true. Enrolling in a high-end coaching program such as Message to Millions is one example of a good investment.

Tip #7: Share Your Blessings

Growing your money can also be done outside of yourself. When you share generously, more people can benefit from what you have. Make your life more meaningful by sharing your blessings with others.

When helping, set your mind to serve others without expecting anything in return. Still, it doesn’t hurt to be smart in choosing whom to help. If you plan to donate to a charity, find out how they handle the funds and where the money goes. After all, you wouldn’t want your money to go to waste.

If these tips are not part of your habits yet, remember that you can always learn how to spend money wisely. The key to making new habits work out for you is consistency. Commit to managing your funds prudently with these effective saving tips and live a more meaningful life by growing and sharing what you have. I hope this serves you.

Do you now understand how to spend money wisely? What steps do you take to make your money grow? I’d love to hear your ideas in the comments section below!

Up Next: 7 Success Habits You Need To Become Prosperous

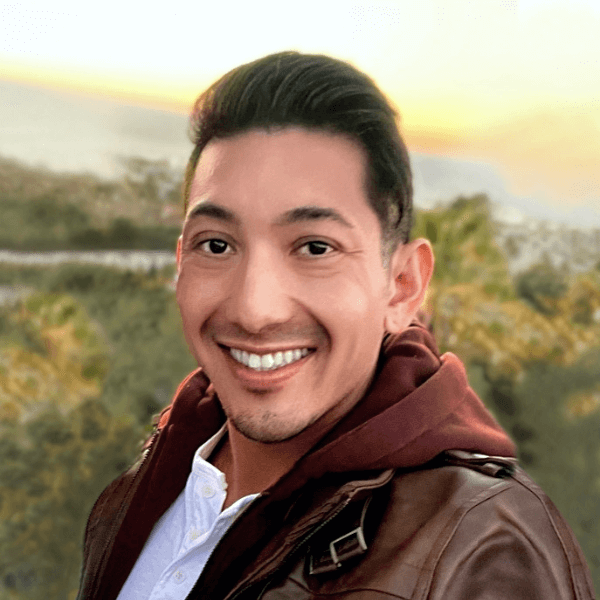

ABOUT THE AUTHOR